Pensions are constantly evolving and there may be changes that affect your membership, so it’s important to keep up to date with what’s happening.

The Tapered Annual Allowance and the three-year carry forward rule

08 May 2022

What is the ‘Tapered Annual Allowance’ and how could it affect me?

The Annual Allowance (AA) on pension savings, is the amount you can save each tax year, across all of your pension arrangements, before tax is charged. For the tax year 2022 – 2023 this limit is either 100% of your annual earnings, or £40,000, whichever is lower.

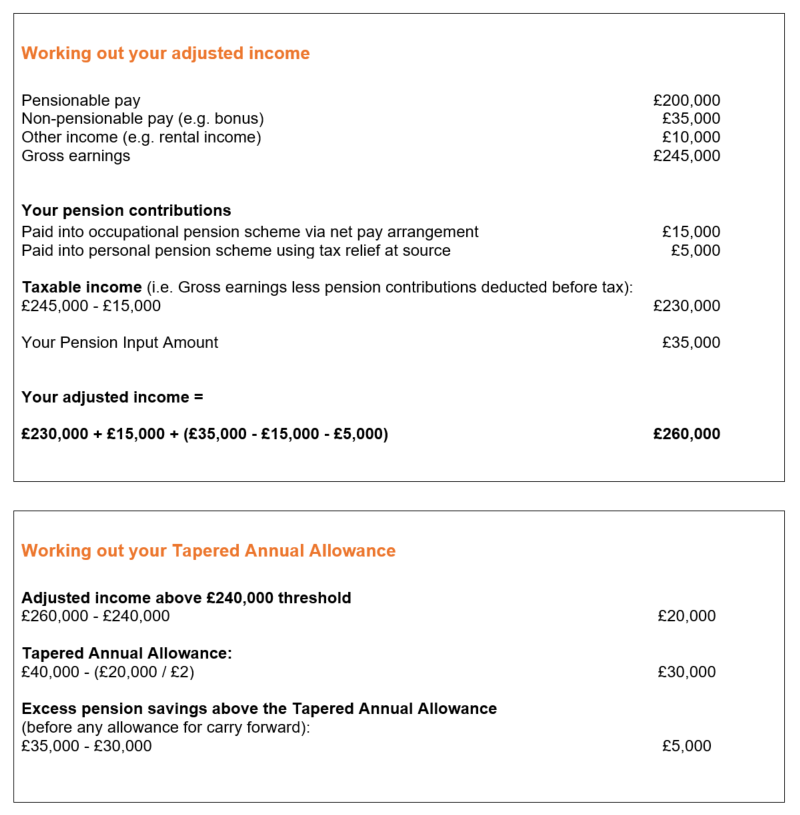

The Tapered Annual Allowance (TAA) on pension savings applies to those with taxable income exceeding £200,000 and “adjusted income” is over £240,000.

What is ‘adjusted income’?

Your adjusted income includes:

- Your taxable income. This can include your income from any and all employment, plus any income you may have from other sources such as property rentals, savings or shares during the tax year, PLUS

- Your pension input amount. This is the value of your pension savings over the tax year, in excess of inflation and including any AVCs or Added Years Pension which is tested against the Annual Allowance. You can find this information on your Annual Benefit Statement

If your ‘adjusted’ income is over a limit of £240,000, your AA reduces below £40,000 on a sliding scale. For every £2 that an individual’s ‘adjusted income’ exceeds this limit, the AA reduces by £1.

The minimum TAA is £4,000 for anyone with an adjusted annual income of £312,000 or above.

So, if your total taxable income is more than £200,000, you may be affected by the TAA and you must work out your ‘adjusted income’. The TAA is unlikely to affect you if your taxable income is £200,000 or less or if your adjusted income is £240,000 or less.

So if you are impacted by the TAA, the amount of your AA is likely to vary year-by-year. See how you can work out your own adjusted income below.

The three-year carry forward rule

You can carry forward any Annual Allowance that you have not used from the previous three tax years to the current tax year. The amount of the unused Annual Allowance can then be added to your current year's Annual Allowance to give you a higher available amount of tax-free pension savings.

This rule may allow you to make occasional large amounts of pension savings without having to pay an Annual Allowance charge. The three-year carry forward applies whether you are subject to the standard Annual Allowance of £40,000 or a Tapered Annual Allowance of between £4,000 and £40,000 (in which case the amount available to carry forward will be based on the unused Tapered Annual Allowance). It does not apply to the *Money Purchase Annual Allowance.

If you exceed the AA or the TAA and have enough carry forward from the previous 3 years to remove the excess. You do not need to do anything.

If you exceed the AA or the TAA and have no carry forward from the previous 3 years to remove the excess. You will be liable for a tax charge on the excess at your marginal tax rate, by way of self-assessment.

If the charge is £2,000 or more and relates to savings made in the Magnox Scheme, you can ask for the Scheme to pay the charge on your behalf in exchange for a reduction in your benefits. This is known as Scheme Pays. Please contact the administrator of the Scheme, Railpen, if you’d like to find out more. Contact Railpen on on 0800 012 1117 or at csu@railpen.com

*The Money Purchase Annual Allowance (MPAA) only applies if you start to take money from pension savings in defined contribution arrangements. In 2021/22 MPAA was set at £4,000.

Did you know..?